Usually this time of year I stick my neck out and make some forecasts about the local market in the coming year. What I’ve discovered is my quotes are boring by comparison to those made by the pundits. So, this year I decided to publish some of the more exciting projections by people who claim to know what’s going on.

Let’s set the stage by noting that the real estate market has been notoriously stable for the past few years. Stable, and on a very slight decline. The charts have shown volume and prices all within the normal range, with tiny losses increasing as time goes on. Several pundits have pointed to these stats and projected a recession on the horizon.

At the same time, as I point out in another article, this is a presidential election year. Can anyone remember an election year when the economy failed? It doesn’t happen very often. Let’s look at some quotes.

“Were we to have a recession, I’d argue housing would provide a cushion because the shortage of supply at the entry-level suggests builders could actually continue to build.”

Doug Duncan, Fannie Mae’s chief economist

Well now, I know quite a few builders and developers. But, I don’t know any who will start a project when prices start dropping. As a theory it sounds great, but I think it needs further study.

“While the housing crisis is still fresh on the minds of many, and was the catalyst of the Great Recession, the U.S. housing market has weathered all other recessions since 1980.”

Odeta Kushi, deputy chief economist at First American

Kushi says, “…since 1980.” So he had to look back 40 years to find good news?!?!

“Housing people are the most optimistic people, but it takes a lot of optimism to buy a house and tie up your income for 30 years.”

Nela Richardson, investment strategist at Edward Jones.

He’s right, at least as far as purchasers would go. Most tenants wouldn’t be very optimistic after renting for 30 years.

“The vast majority of housing economists project that mortgage rates will remain below 4% in 2020.”

Jacob Passy, personal-finance reporter for MarketWatch

Ha! Like we’re going to see the Fed argue with President Trump! He tweeted and they gave. It’s an election year!

“In the Los Angeles metropolitan area (which includes Orange County), the share of homes that sold for more than the listed price dropped from nearly 35 percent in 2018 to 28 percent in 2019.”

Elijah Chiland, reporter for Curbed, Los Angeles

There is a large difference between our little corner of the world here in 90277 and Los Angeles County in general, and it extends to the LA Metro and to California and to the nation as a whole. In 2019 only 17% of homes sold in 90277 sold for over asking. It is different here. Many brokers/agents have found that the statistics generated by state and national pundits are simply not applicable in the Beach Cities.

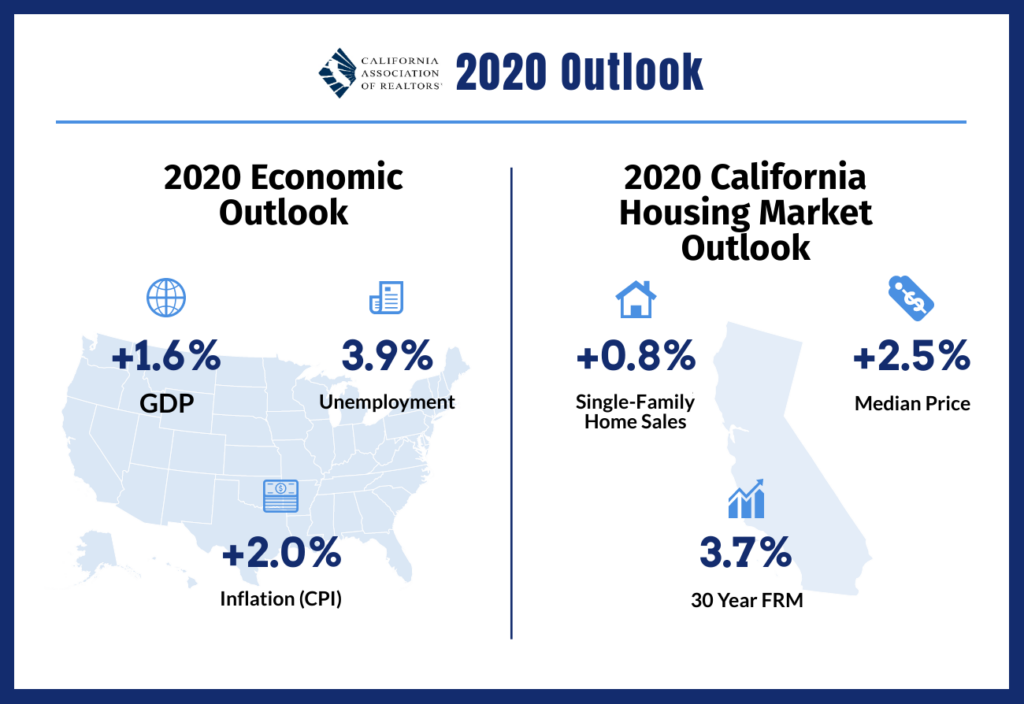

Here’s CAR betting on a positive market for the year! It’s an election year, and I can see this happening!