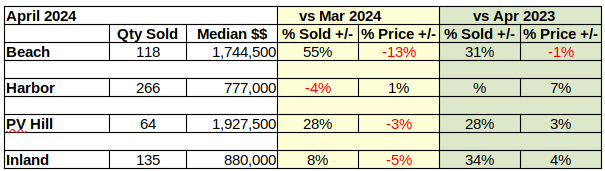

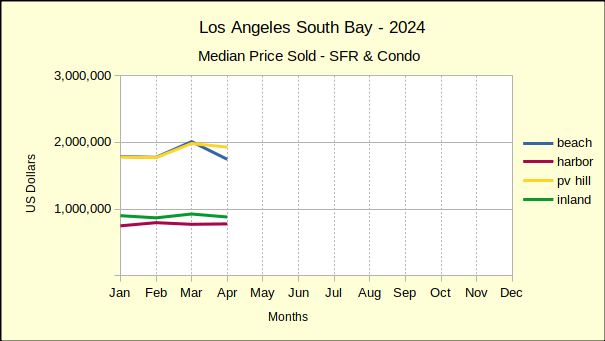

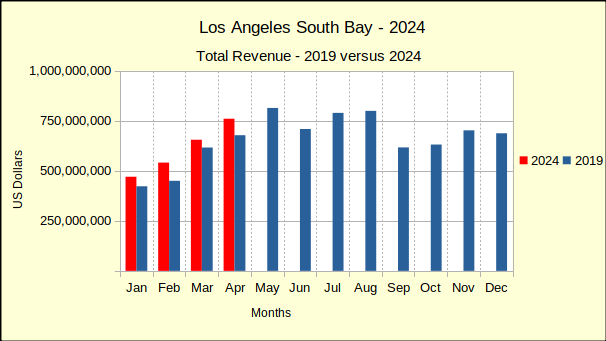

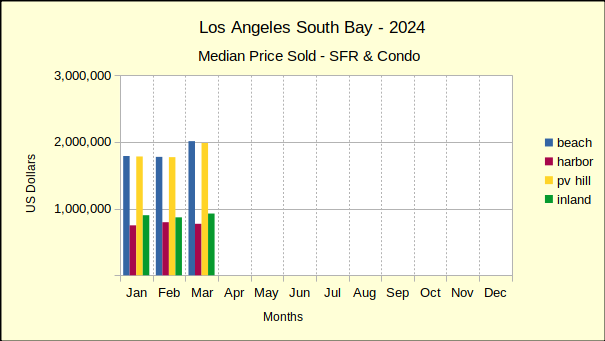

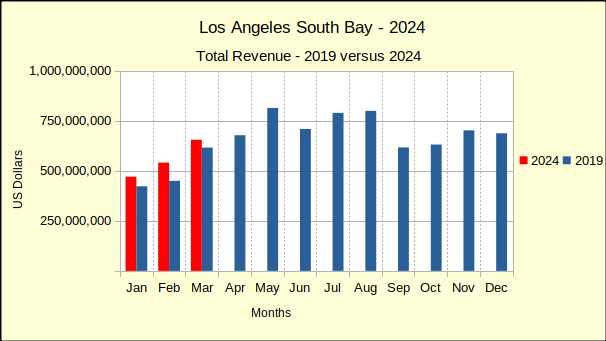

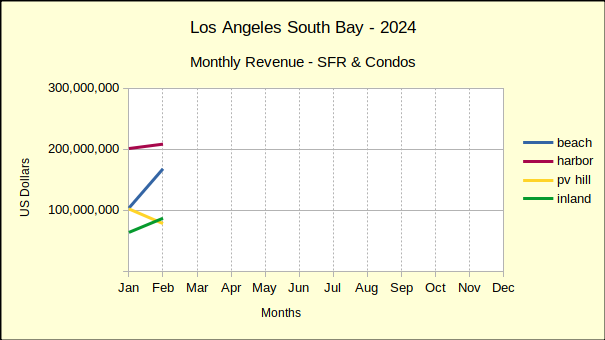

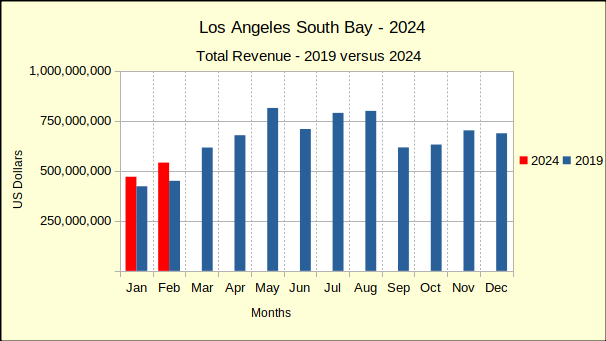

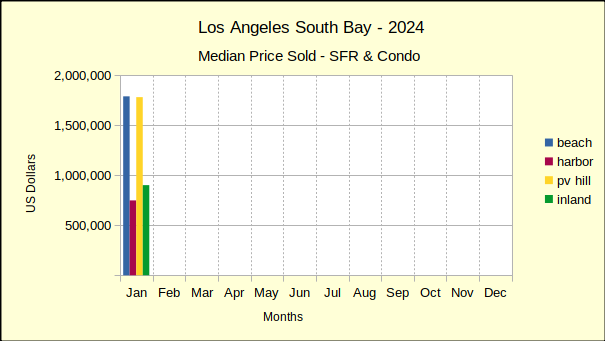

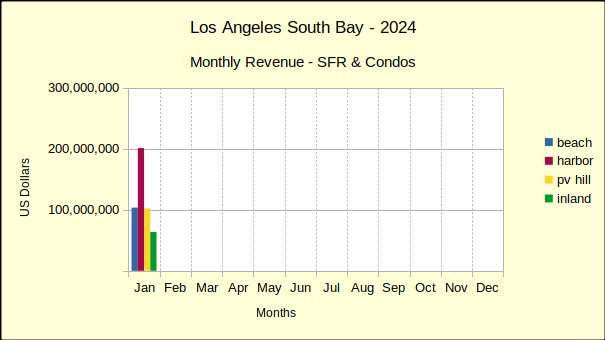

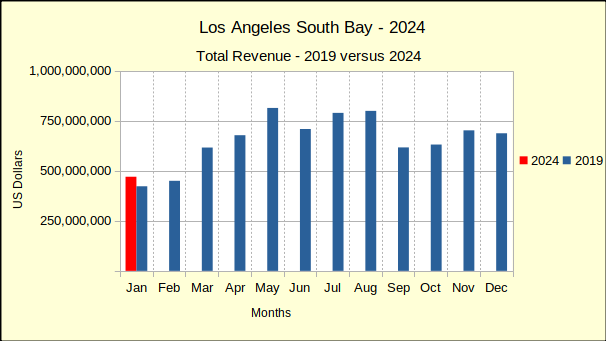

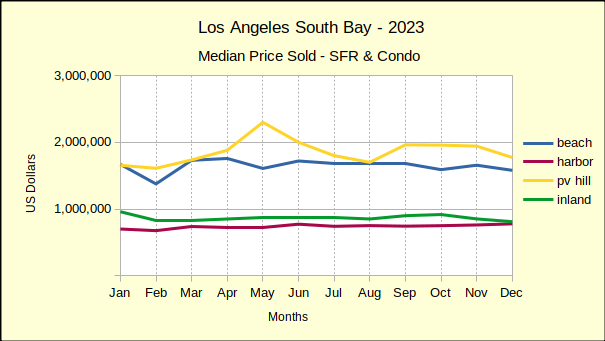

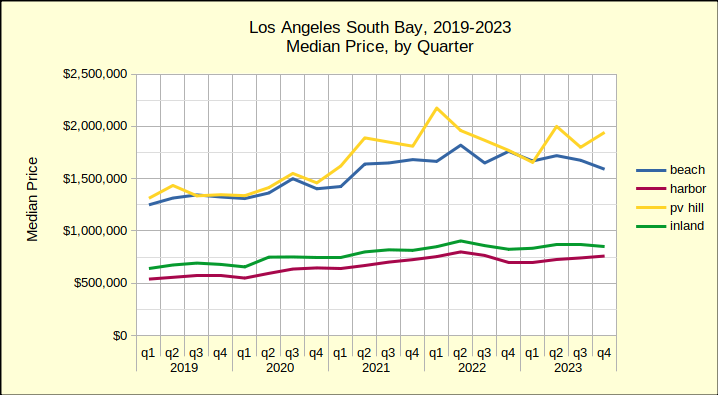

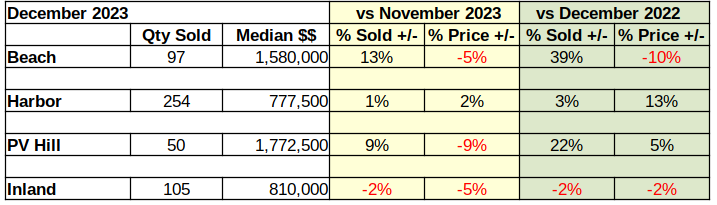

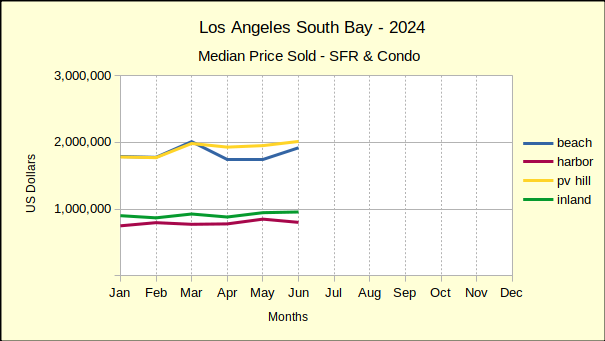

Median prices for real estate around the Los Angeles South Bay have risen over 40% since 2019, the year before the corona-virus pandemic. Comparing the median prices and sales activity for the first half of 2024 shows increases approaching 50% for the five year period in all areas across the South Bay.

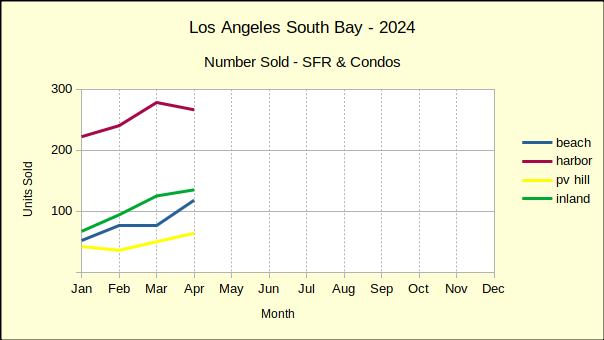

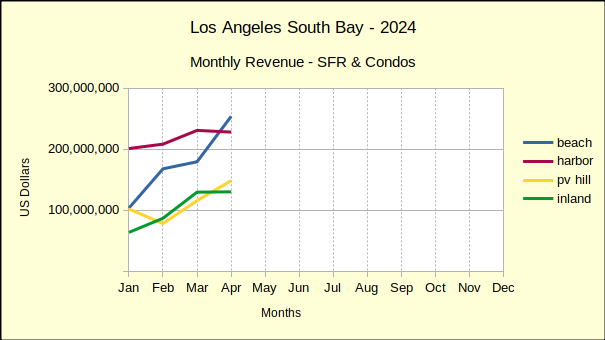

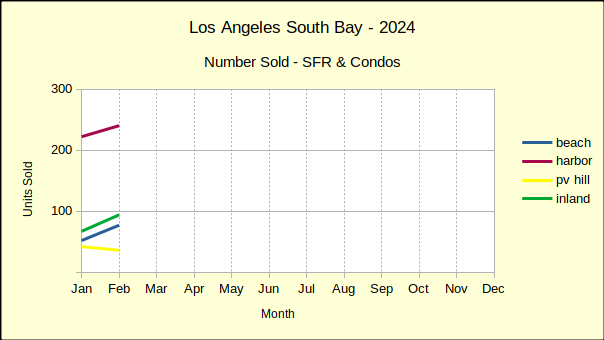

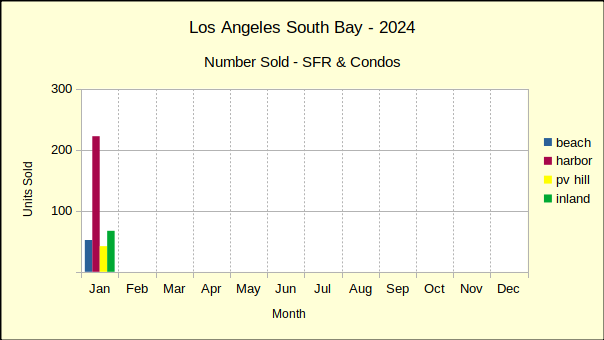

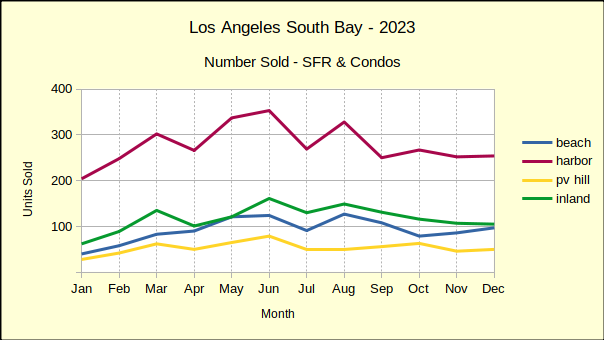

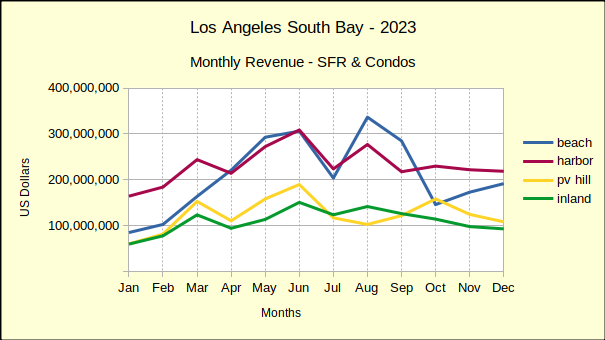

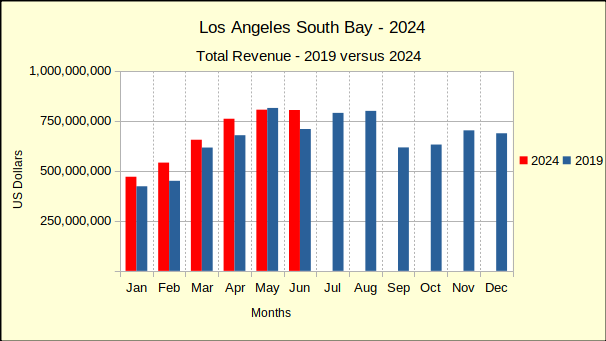

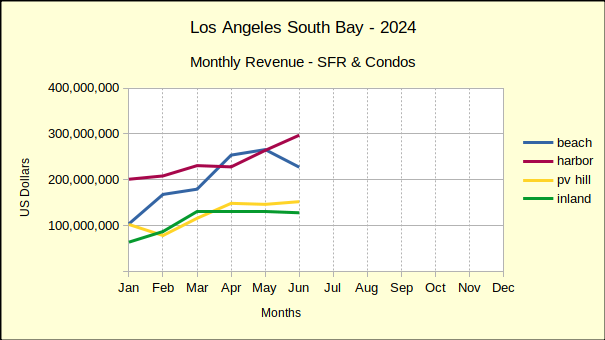

Over the same time period, sales volume has plummeted by 22%, falling from 4,022 in 2019 to 3,149 in 2024. The Beach cities have been particularly hard hit with a 34% drop in the number of homes sold during the first six months of the year.

Looking at 2024 versus 2023 shows a similar pattern with median prices up nearly 10% from the first half of last year. The Beach area showed the lowest increases, coming in at 5% above the 2023 median.

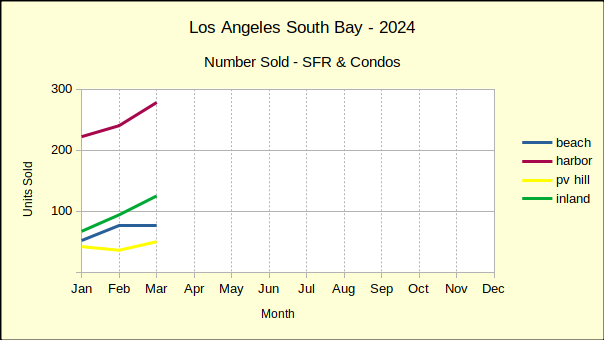

Sales volume was off by 2% across the area with the only positive being the Beach at a mere 1% above 2023 numbers. As the 2024 year has progressed, the number of sales has declined in total. Simultaneously, more and more parts of the South Bay have fallen into negative growth.

As of the end of June, 2024 sales figures for all areas were negative in comparison to June of 2023. While the number of homes sold has consistently declined through the first half of the year, median prices have been equally persistent at increasing over last year. Most experts are attributing the increasing prices and decreasing sales to the shift from an ultra-low mortgage interest rate during the pandemic, to a comparatively high rate currently.

When rates were at the lowest, many homeowners took advantage of the opportunity to refinance at the incredible rates. Those folks are now in a position where they would incur a painful increase in monthly living costs if they were to move. That has resulted in about a 40% reduction in the number of homes typically available on the Multiple Listing Services (MLSs).

At the same time, the increased mortgage interest rates have pushed a significant number of potential sellers out of the market because they no longer qualify for the loan they would need to trade up to a larger or newer home. That reduced the available inventory of resale homes even further and became another contributing factor to the bidding wars among the few buyers still in the market.

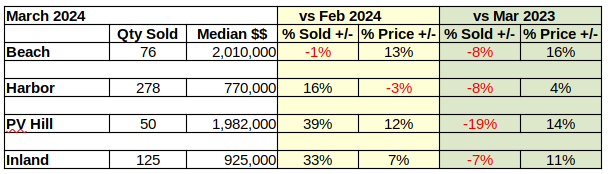

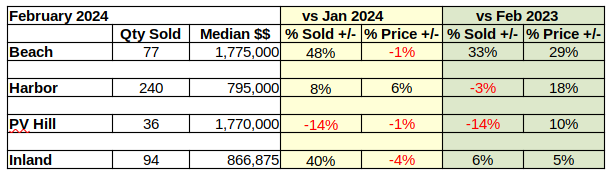

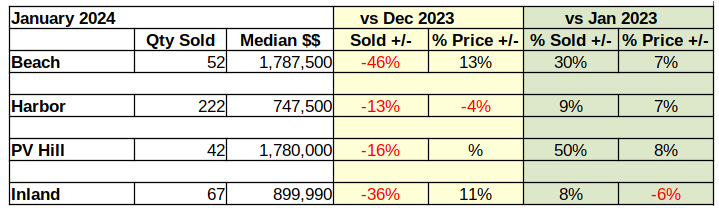

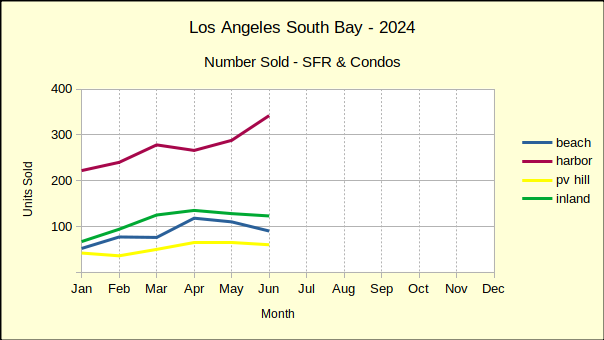

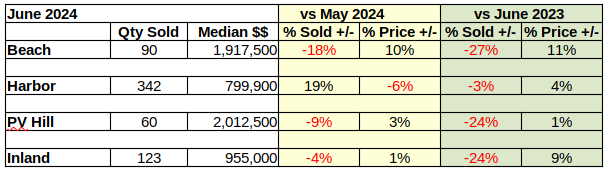

Beach: Down 18% in Sales May to June

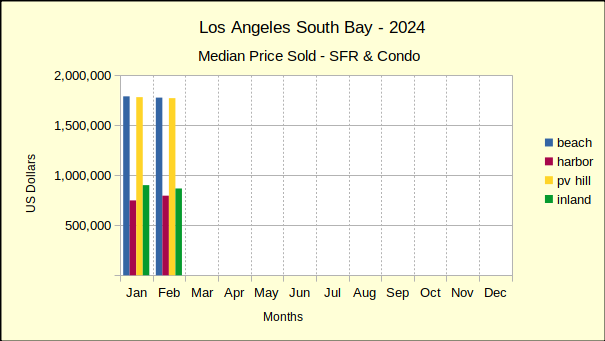

Monthly sales volume fell from 110 units in May to 90 homes in June, for an 18% drop. Median price jumped 10% in one month to end at $1,917,500.

Year over year, the number of homes sold declined from 124 in June of last year to 90 this year for a loss of 27%. Median price for the Beach climbed 11% over the year.

Year to date for the first half of 2024 versus the first six months of 2023 shows a modest increase of 1% in sales volume along with a increase of 5% in median price.

Harbor: June Median Price Off by 6%

The Harbor area was the outlier for June. While month over month sales collapsed and pricing jumped for the other three areas, Harbor sales of 342 homes boosted sales by 19%, coming in well above the 288 homes sold in May. Meanwhile, median price went the other direction, dropping from $848K in May to $799,900 in June, for a decline of 6%.

Year over year statistics went the opposite direction, following the rest of the South Bay. Sales volume fell by 3%, dropping from 124 in 2023 to 90 in June of this year. Meanwhile the median price was up 4% for the year, rising from $772,000 last June to nearly $800,000 this year.

The first six months of 2024 brought a year to date sales drop of 4%. The median price in the same period climbed 9%.

Short term changes, as from month to month, have been unpredictable since the pandemic. Looking at the longer term, there is consistency in the declining sales volume and increasing median price. With 2024 a presidential election year, it will be interesting to see how long this direction holds.

Hill: Year Over Year Sales Fell 24%

With a reputation for wildly shifting statistics, the Palos Verdes Peninsula came in with relatively modest decline of 9% from May sales. Similarly, the increase in median price was very tempered at only 3%.

The sales volume for same month last year was anything but mild. June of 2023 reported 79 homes sold versus 60 homes in June of 2024. That’s a 24% drop in volume from last year. While a fourth of the 2023 sales disappeared, the median price eked out a 1% increase, going from $2,000,000 last June to $2,912,500 in June of 2024.

In what is becoming a familiar trend, the year to date sales volume is down 2%, and the median price for the first six months of the year is up 7%.

Inland: June 2024 Sales Drop 24% From 2023

The Inland area showed the smallest month to month change of the South Bay. The 4% drop in sales volume from 128 homes sold in May to 123 in June was minor. Likewise the 1% increase in median price from $945,000 to $955,000.

Like the Hill, the Inland area had a radical drop in sales from June of 2023 to June of 2024. Falling from 161 homes sold last June to 123 sold this June resulted in a 24% drop in transactions. Median price in the same period rose 9%, from $875,000 to $955,000.

Interestingly, there has been no statistically significant change in the sales volume for the first six months of the 2023 and 2024 years. It actually increased by three units from 669 homes sold in 2023 to 672 homes sold in the first half of 2024. For the same time periods, the median price climbed by 6%.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo Montemalaga Sunset by Carl Clark