In the first quarter of 2021 buyers and sellers were taking advantage of the artificially low interest rates. Sales were robust and the demand pushed prices up along with the increase in sales volume. By first quarter 2022 sales volume was waning, but sellers were still attached to the higher prices so we saw sales dropping off dramatically. The first three months of 2023 gave us even deeper cuts in the number of South Bay homes sold and brought some corresponding declines in median prices. Today, looking at the South Bay market for the first quarter of 2024, prices are still “sticky” with sellers hoping to hang onto the gains from the Covid years.

It’s not working real well. January gave sellers hope with a strong growth in sales volume and modest increases in median price. February showed returning median price increases and buyers backing off again in response. March is back to the drawing boards as buyers have balked at the price increases in the face of continuing elevated interest rates.

This is coupled with news trickling out of the Federal Reserve Board about how mortgage interest rates are probably not going to see the three rate decreases predicted at the beginning of the year. The latest announcement confirmed that if rate decreases come at all, it won’t be until late in the year and it won’t be significant.

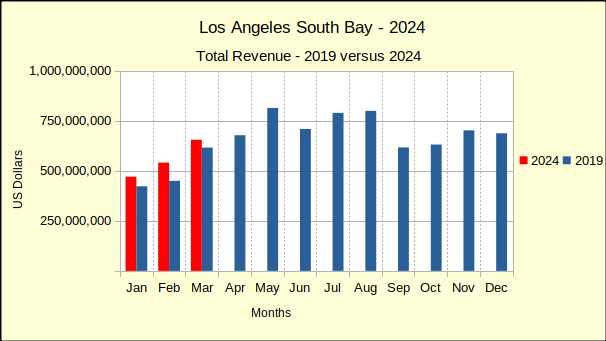

To gain perspective on the impact to the real estate market, it must be noted that the number of South Bay homes sold during the first quarter of 2024 is nearly identical to last year, and is still 19% lower than the first quarter of 2019, the last year of normal business before the pandemic. At the same time the median price of those homes is up almost 10% over last year and is 40% higher than it was in 2019.

Somehow a 40% increase in cost within five years, with a negative demand, seems to be a violation of general economic principles. It appears the post-pandemic adjustment back to normality has digressed somewhere along the path. Of course, all this has been further impacted by the fact 2024 is a presidential election year, and simultaneously the world is in extreme turmoil both economically and physically.

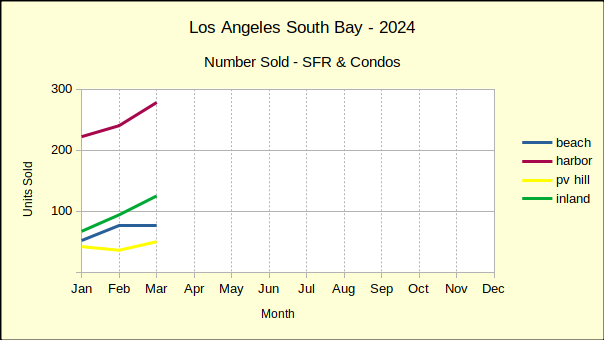

Month by month performance has been unusually erratic for quite some time. So far this year the comparison of this month to the same month last year is the most stable view of the real estate market. According to that view, the number of homes sold has gradually slid into negative territory. January kicked off the year with a blanket increase in the sales volume. February flipped that showing for about half the South Bay. which slid below the sales of last February. March has furthered that negative sales volume to all areas of the South Bay.

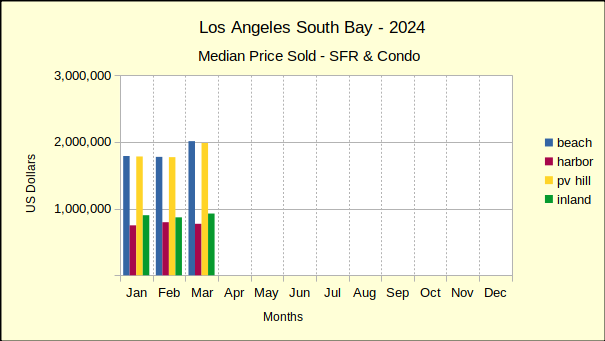

Median prices are managing to stay above those of 2023. With sales down across the area and mortgage interest rates stubbornly increasing, that may be changing soon.

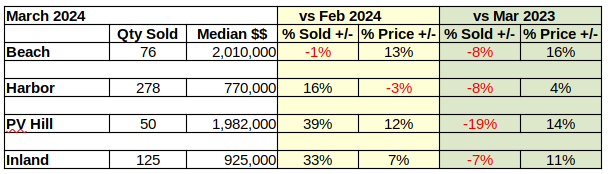

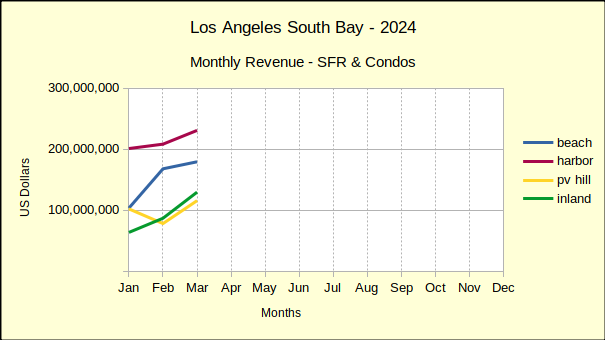

Beach: Home Sales Erratic

The Beach cities truly exemplified the erratic nature of month over month statistics during the first quarter. Compared to the prior month, sales in January were down 46%, in February up 48% and in March down 1%. Using the same metrics, monthly median prices were up 13%, down 1% and up 13%.

Looking at the same three months in a year over year method, the statistical movement is much less dramatic. Compared to the same month last year, January sales volume was up 30%, February up 33% and in a surprise drop, March was down 8%. By the same token, median prices were up 7%, up 29% and up 16%.

Disconcertingly, it’s been two years since the pandemic ended and the market is still seeing double digit movement monthly in both volume and pricing. This lack of stability results from several different influences on the real estate market. Among them the continued increase in mortgage interest rates, a corresponding relaxation of qualification requirements by lenders, a public perception of good economic conditions and a continued shortage of homes on the market.

Year to date sales volume for homes at the Beach has increased 13% while median prices have risen by 7% over 2023. Compared to 2019, sales are off by 35% with median prices 43% higher.

Harbor: Up, Then Down, Then Up

Month to month activity for the first quarter in the Harbor area has followed an equally irrational pattern to that of the Beach. January saw sales and prices drop by 13% and 4% respectively. Then February brought increases in both numbers, volume going up 8% and the median price by 6%. March came in mixed with sales volume up 16% while the median slipped by 3%. Annually, homes in the Harbor area started the year on a positive note with 9% growth in number of homes sold and an accompanying 7% growth in median price. February saw sales decline 3% with an increase in median price of 18%. Sales volume continued to fall in March, decreasing by 8%, albeit with a 4% increase in median price.

Year to date for the first quarter shows the number of homes sold declined by 2%, while the median price increased by 10%. Compared to 2019, sales are off by 16% with median prices 43% higher.

Hill: Sales and Prices Up; Sorta

After two months of negative sales volume and falling median prices, home sales on the Hill perked up in March. Volume was up 39% with 50 properties sold and median prices took a 12% jump to $1.982M. As mentioned in the past, properties on the Palos Verdes peninsula, much like those in the Beach cities, represent a smaller segment of the marketplace and often one or two outsize transactions will create a major shift in the statistics.

Of course, that “perkiness” is relative. While the number of homes sold was 39% higher than February, it was still 19% lower than March of 2023 and 25% below March of 2019, the last year prior to the upsets of the corona virus pandemic.

The 19% drop in sales was accompanied by a 14% increase in median price, a contradiction seen around the South Bay and generally across the State. The typically accepted explanation is that many home owners took advantage of the low mortgage interest rates offered during the pandemic. Those people are now unwilling to take on a new mortgage with an interest rate two to three times higher than they are currently paying. This is leaving a much smaller selection of available homes and has created an inventory shortage which encourages competitive bidding among the few buyers active in the market.

The first quarter of the year brought a 3% decline in homes sold on the Hill and an 8% increase in median price. Compared to the first three months of 2019, sales are currently off by 11% and the median is up 36%.

Inland: One Good March

The number of homes sold in the Inland area for March jumped by 33% to 125 closed escrows. Median prices increased a more modest 7% to $925K. Like the Harbor area, there is a comparatively large number homes in the Inland area and they offer a diverse range of prices. As an example, the low sale for this March was $371K while the high was $2.525M. Mathematics is a great tool for analyzing trends in real estate, but if one is planning to buy or sell in this environment, you should call a professional rather than simply applying these statistics.

Compared to the same month last year, March sales volume was down 7%, while the median price was up 11%. Year to date, the sales volume for the Inland area was unchanged, and the median price was up 8%. Similarly, comparing to 2019, sales were down 12% and prices up 40%

As discussed earlier, there’s a tendency for buyer resistance to the combination of higher prices and higher interest rates. Three months into the year, that resistance seems to be growing. Since the most recent Federal Reserve announcement, mortgage interest rates have climbed about .375% (3/8ths of a point). Looking at the statistical trend in conjunction with the increasing interest rate, we anticipate continued slippage in volume and more declines in median price throughout the South Bay.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo of the San Pedro coast by Marius Christensen on Unsplash