You might think lenders would need to do a bunch of fancy calculations to determine how much money you can borrow. There are certainly several factors that go into the final calculation, but if you want a rough estimate, it’s actually relatively simple. Lenders tend to use one of two formulas, either mortgage payment as a percentage of gross monthly income, or debt to income ratio.

Both of these factors involve your gross monthly income — that is, the amount you were paid before deductions from social security and taxes and before making any payments or contributing to savings. Where they differ is what your gross monthly income is compared against. The first method calculates what your monthly mortgage payment would be based on actual interest rate and ensures that it doesn’t exceed 28% of your gross monthly income. The debt to income ratio method compares your gross monthly income against your debts, such as credit card debt and other loans. These existing debts plus your new loan payments should not exceed 36% of your gross monthly income. Both these methods do require knowing the interest rate, which is determined by several factors, but if you know about where interest rates are, you can make an educated guess.

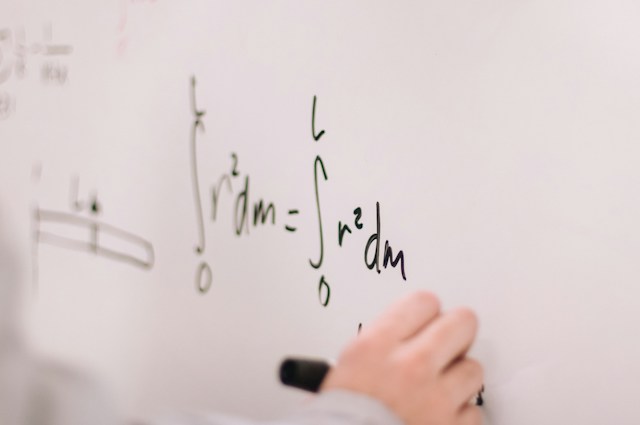

Photo by Jeswin Thomas on Unsplash