With four months left in a very chaotic real estate year, we want to take this opportunity to lay some ground work for understanding why the market has headed into a recession. And, to keep things on a positive note, we end with a couple of suggestions on how you might profit from this turn of events.

Some of the nation’s most respected analysts (including Ivy Zelman of Zelman & Associates and Mark Zandi of Moody’s Analytics) are predicting recessionary price drops ranging from 10-20% and lasting through the next two years. (Arguing that we’re only looking at a brief correction, pundits at Goldman Sachs and the Mortgage Bankers Association continue to predict single digit growth.) Meanwhile, here on the street, we’re watching prices drop across the board for the second month in a row.

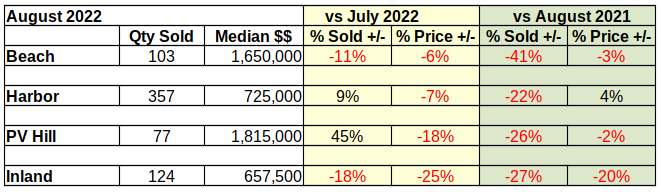

In August we reported that median home prices across the Los Angeles South Bay fell from July, the prior month. Now looking at August sales we find all four areas of the South Bay showed declining median prices again. The month-over-month price drops ranged from 6% at the Beach to 25% in the Inland cities. (See bottom for description of areas.)

Underlining the month-to-month price slippage, three of the four areas also showed declining prices versus the same month last year. Only in the Harbor area are homes still selling for more than they did in 2021. Even there, median price has slid from 9% down to 4% above August of 2021.

2022 Compared to “Normal” Business in 2019

The past two years have seen real estate stumble with the Covid lockdowns in 2020, then skyrocket with the low interest rates in 2021. It’s worth a look back to 2019 to see how the current conditions compare to the most recent “normal” market.

Looking at sales volume in the period January through August of 2019, 1064 homes had sold in the Beach cities. So far this year only 905 homes have sold. That is a 15% drop in sales since the last normal year of business. The trend line for the Beach area has been sliding downward since April.

For the first eight months of 2019 the Harbor area showed sales of 2955 compared to 2945 for this year. That is a drop of .3% – a statistically insignificant change. However, the trend line has been dropping since March. August sales were up slightly from July, which was an unusually slow month for the Harbor area. We expect sales to continue a downward trajectory into 2023.

Palos Verdes home sales for the same period in 2019 totaled 537 versus 568 in 2022. The Hill is the only part of the South Bay where year to date 2022 sales exceed those of 2019. At 6% it’s a healthy increase, too. Despite being the best performing area in South Bay, Palos Verdes sales volume peaked in March and continues to slide. Sales in July were unusually weak, so August shows an upward step in the trend line.

Sales in the Inland area, very much like the Harbor area are down only .4% from 2019 sales for the same period. The difference is statistically insignificant, and the trend line is headed downward.

Declining sales volume creates a larger inventory of homes to sell. As the inventory grows, sellers have more competition and buyers become more demanding and prices start declining. We anticipate continuing growth of available inventory, followed in late fall or early winter by a spate a price drops.

Median Price Up 54% Since 2019

Palos Verdes homes have seen the greatest impact of the Covid-era buying mania. Comparing median prices from the first eight months of 2019 to the first eight of 2022, we find a 54% escalation on the Hill. Normal growth over a three year period would have created 9-10% in price appreciation. Expect much of that excessive price expansion to be erased over the coming months.

Compared to 2019, Beach area median prices have shot up by 32%. This is easily three times normal growth. As we see in the chart below prices started adjusting downward as early as May in the Beach cities.

Since 2019 median prices for the Inland area have climbed 30%. Here in the August 2022 chart below we see Inland area prices have been dropping steadily since May when the median was $910K. During that four month period values have slipped by over $50K.

In the Harbor area home prices have escalated 34%. From 2019 at $565K to 2020 at $607K the Harbor area median grew $40k. Then in 2021, it added another $90K reaching $700K. So far in 2022 the median has reached as high as $830K – another $130K increase, but has now dropped back to $725K, losing $105K off the June median.

Most home buyers are constrained by their income to a particular price range, and salaries have not increased at a rate even remotely similar to real estate prices. Recent studies have shown about 25% of potential buyers were priced out of the purchase market in California by the soaring Covid-era prices.

Interest Rate Shrinks Annual Sales Dollars

In total sales dollars for January through August of 2019, the South Bay weighed in with $5.3 billion. During the same period in 2020 the aggregate amount shrank back to $4.9 billion, followed in 2021 by an upward explosion to $7.9 billion. So far in 2022 the area has reached $6.9 billion.

Each time the Federal Reserve System (fed) increases the short term interest rate the pool of potential buyers shrinks again. As this is written, the Fed is preparing to increase the rate by at least .75% in mid-September and two more increases are anticipated by the end of 2022.

At the current rate of declining value, we estimate the 2022 annual sales value to be approximately $9.5 billion, a decrease of 27% from 2021. Remember that huge budget surplus California had last year? Do not anticipate another this year, and possibly not for a couple of years as the state works its way through this recession.

The Silver Lining in the Cloud

One theory of success in real estate is “Buy low, sell high.” Flippers subscribe to that concept, buying at the bottom, updating and selling at the top of the immediate market. Another theory, not as well supported, but statistically more profitable, is “Buy and Hold.” Buy a piece of property at the best price you can and use it or lease it but – never sell it.

A deep market adjustment doesn’t come very often, so when it does one should take maximum advantage. At the moment it appears there will be a heavy price contraction starting late this year. We’ll know better in late fall and early winter, but all indications today are that a wise property investor should be preparing to buy at the bottom of the market – soon. We constantly search the Southern California coast for outsstanding investment bargains. Tell us what you want to invest – we’ll tell you where to buy.

Methodology

For purposes of comparing homes in the LA South Bay, we have divided the South Bay into four areas. Each is composed of homes of roughly comparable style, geographically similar location and physical characteristics, as well as approximately similar demographic characteristics.

The areas are:

Beach: comprises the cities of El Segundo, Manhattan Beach, Hermosa Beach and Redondo Beach;

PV Hill: comprises the cities of Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills and Rolling Hills Estates;

Harbor:. comprises the cities of San Pedro, Long Beach, Wilmington, Harbor City and Carson;

Inland: comprises the cities of Torrance, Gardena and Lomita.

Main Photo by Amelia Noyes on Unsplash