September Home Sales Down 35%

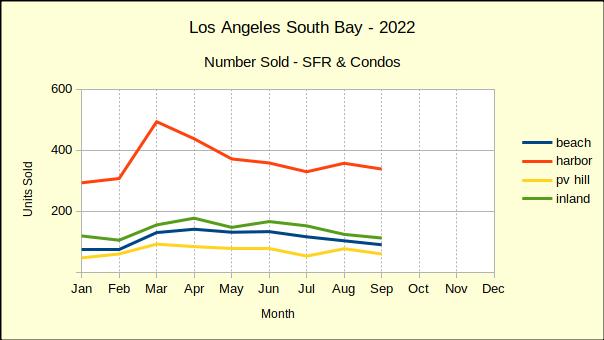

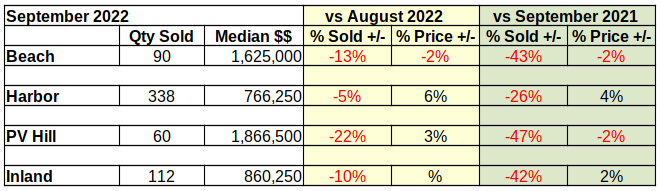

Last year saw home sales in the South Bay escalate dramatically as buyers sought to become homeowners while interest rates were still abnormally low. With interest rates rapidly rising it’s no surprise that sales are plummetting in 2022. The Harbor area, traditionally an entry level market, handily out-sold the balance of the South Bay with a drop of only 26%. The remaining areas suffered sales drops ranging from 42% to 47%, with the South Bay as a whole dropping 35%.

Compared to last year, cumulative South Bay home sales were down 21% as of September. The first three quarters of 2021 saw 7767 townhomes and single family residences sold, versus 6163 during the same period this year.

Recognizing that 2020 and 2021 were exceptionally aberrant, we also compared the 2022 year-to-date sales volume to 2019, the last normal year of business prior to the pandemic. As of the end of September 2022 cumulative sales volume was 4% lower than it was for the first nine months of 2019.

The decline from 2019 sales is uneven in that the biggest drop, 15%, is seen in the Beach area, which is typically at the high end of the market. Sales in the Harbor area only dropped back by 2%, while sales in the Inland area fell by 4%. The Palos Verdes peninsula fared best, actually increasing in quantity sold over 2019 by 4%. As always we offer a cautionary note when looking at statistics for property on the PV Hill. Because there are considerably fewer homes in that area, percentile statistics can take large swings.

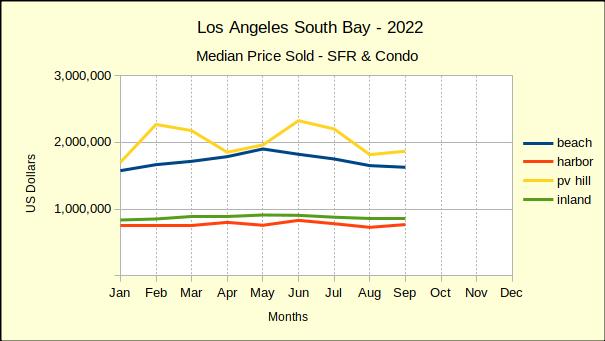

Median Prices Mixed in September

The number of homes sold in 2022 has declined, indirectly affecting the median price of those homes, as well as the total dollar value of all the homes sold in the same period. A closer look at the median price of homes sold through September yields some surprising changes.

Since prices increased dramatically during the coronavirus pandemic we anticipated finding the median price from 2022 to be considerably higher than that of 2019. Indeed, that is the case with the median in the Beach area up 31% over that of 2019, the Harbor up 36%, PV Hill homes up a staggering 47% and the Inland area up 30%. But, that is gradually reversing.

July and August of this year showed depreciation in the median price across the South Bay. Prices consistently dropped in a range from 2% down (Inland) to 18% down on PV Hill. September sales broke the pattern with only the Beach cities losing value per the median. The Inland area was flat, showing no change from August. In an unexpected twist, both the Harbor area and the Hill came in with an increase in the median price. The growth was modest, up 6% for the Harbor area and up 3% for the Hill. Despite the slight improvement in September prices we anticipate continued downward pressure as inventory grows and time on market stretches.

Looking at the median price on a year-over-year basis, we find September with minor declines from August. The Palos Verdes cities showed prices dropping by 2% last month and this month. At the same time the Beach cities dropped 2%, while the Harbor and Inland areas increased by 4% and 2% respectively.

Median prices started 2022 with increases regularly coming in well above 10% growth. In April we saw the first negative where the median for the Hill fell 2% from 2021. Since then we have watched the rate of price appreciation decline from double digits until now in September with both the Beach and PV areas losing value.

We fully expect all areas of the South Bay to reflect declining median prices before the end of the year. While prices will be down on both a month-to-month and year-to-year basis, we don’t anticipate the median to fall below 2019 price points this year.

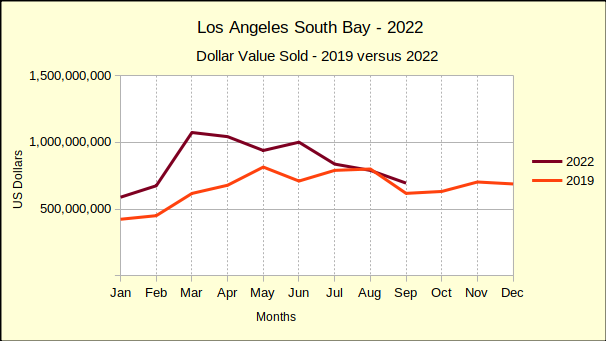

Total South Bay Sales Dollars

When the number of sales is decreasing and the median price of those sales is also decreasing, one has to assume the gross revenue will also decrease. Governor Newsome has been warning for several weeks that the 2022-23 fiscal year will not see the State level revenue surpluses California has been enjoying.

During the first quarter of 2022 gross revenue from real estate sales remained predominately positive, with year-over-year growth rates of about 6% per month. Since March the South Bay has only seen two instances of sales growth, 7% in the Harbor area for April and 3% in the Inland area for June. Every other entry on the chart is negative, with September declines averaging about 40%.

Cumulative sales for the first three quarters of 2022 were off by 29% compared to 2021. Our monthly sales dollars chart shows a zig-zag downward trend since spring of this year. Of course, 2019 is a more realistic point of comparison as a result of market gyrations created by the pandemic and our government’s fiscal response.

Comparing 2022 sales totals to 2019 yields a clearer picture of the current direction of the market. Instead of a sea of red ink, we can clearly see that 2022 sales have remained above those of 2019 with the exception of August. Sales started normally, then in March the Federal Reserve Bank announced a .25% interest rate hike, and promised more to come.

Buyers threatened with increasing monthly payments jumped into the fray and pumped sales up for a couple months. Then a new .5% increase, accompanied with the promise of multiple .75% increases throughout the year began a downward slide in home sales that is continuing.

Following the trajectory of the maroon line, and assuming the interest rates continue to increase, we predict 2022 sales will drop below 2019 again in October. The Federal Reserve Bank has already announced plans for another .75% increase in November, followed by a .5% increase in December. Adding another 1.25% will bring the full increase for the year to 4%. We envision the fall in sales growing steeper, bringing total sales below that of 2019 for the final quarter of the year.

Statistical Summary

This would be the heart of the discussion if we were dealing with a normal fiscal environment. Here we could talk about month-to-month changes and changes from the same month last year to this year. Instead we’re faced with an unanticipated side effect of the pandemic—out-of-control inflation followed by a steep recession.

The areas are:

Beach: comprises the cities of El Segundo, Manhattan Beach, Hermosa Beach and Redondo Beach;

PV Hill: comprises the cities of Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills and Rolling Hills Estates;

Harbor: comprises the cities of San Pedro, Long Beach, Wilmington, Harbor City and Carson;

Inland: comprises the cities of Torrance, Gardena and Lomita.

Goodbye Marymount, Hello UCLA!

Marymount California University, is no more. But, shed no tears! The prestigious University of California at Los Angeles plans to open the site for classes in the fall of 2023-24. Escrow had not yet closed as of this writing, but all appears to be moving forward at good speed.

We are told the finalists included four developers and three educational institutions. We’re pleased that UCLA was the successful bidder. We’ve heard some of their ideas and look forward to having them as neighbors.

However, we’re also interested in what kind of potential the developers saw in this deal. There’s a total of 11 acres already developed as residential and 24.5 acres developed as a campus. What would that have looked like if a residential developer purchased the site?

The 24.5 acres, some of it with gorgeous ocean views, is the jewel in the transaction. A little “back of the envelope” calculation says that using an average of 15,000 square feet per lot, Which is about the average in that neighborhood, one could build about 70 high end homes at the location. New construction on similar sites is selling for about $7.5M today, giving a value for the finished project of approximately $525M. Not bad for a land purchase of $80M, especially considering we haven’t started looking at the 11 acres.

There exist some legal complications in the 86 unit, 11 acre property. Deed restrictions purported to require the land to be used to house students. That can readily be accommodated by an educational institution, like UCLA. Developers on the other hand might have to pay some serious legal costs to do anything else with the land.

And it might have been worth the legal expense. A quick look at the apartment building market in the South Bay shows roughly comparable buildings selling for about $420K per unit. That would make 86 units worth about $36M, almost half the stated purchase price.

We’ll never know what might have been. The entire South Bay can look forward though, to an educational revival. A refreshed campus with UCLA’s academic resources and access to the university program at AltaSea and other port projects is a great starting ground.