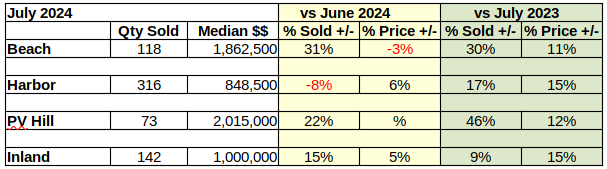

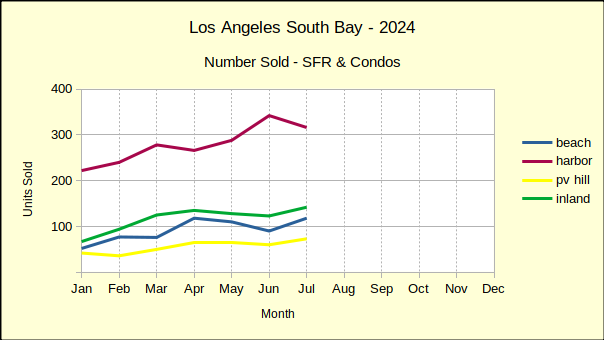

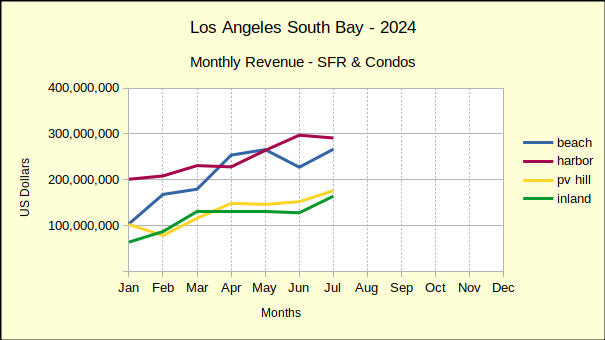

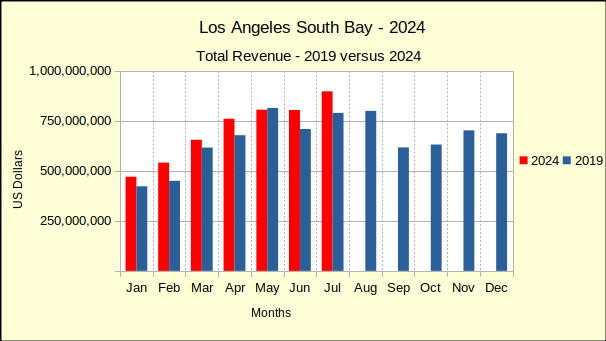

July brought a bonanza—of sorts—to real estate in the Los Angeles South Bay. Sales volume, which had been falling below last year for three of the last four months jumped up 20%. Granted, July was an unusually slow month in 2023, compared to most years including 2024.

Month over month showed a comparable increase. Total sales volume was up 6% from June to July. The only negative for monthly sales was in the Harbor area where activity was off by 8%.

More importantly, year to date through July, sales volume was up 1% across the South Bay compared to the same period in 2023. With over half the year past already, some growth is a positive sign. This close to November on a presidential election year, one would expect the market to be looking better than it has been.

In fact, The number of homes being sold has still not recovered from the pandemic. Sales this July were 22% fewer than they were in July of 2019! As discussed previously, because the mortgage interest rates were temporarily at rock bottom, about 40% of the homeowners in California currently are “trapped in a mortgage they can’t afford to leave.” This promises to maintain downward pressure on home sales for the better part of a decade. Paradoxically, the reduced inventory is contributing to rising prices.

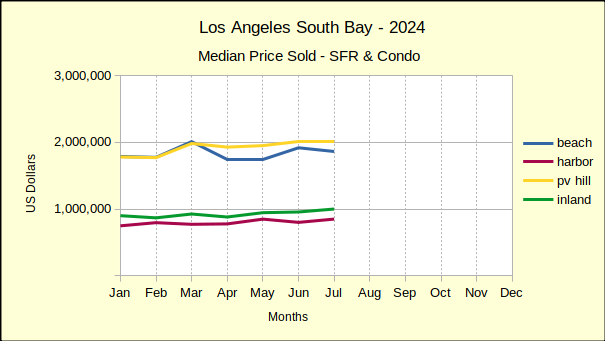

More homes were being sold in July, and they were being sold for greater prices. Annual increases in the median price were up 15% in entry level neighborhoods. At the Beach and on the Hill median prices didn’t reach quite as high, but were still more than 10% above July of 2023.

Monthly pricing showed the contrast between high end and entry level homes more clearly. In the Beach area the median dropped 3% from June, while on the Peninsula, there was no change in the median price. In contrast, the Harbor and Inland areas rose 6% and 5% respectively over June numbers.

Comparing the first seven months of this year to last year shows inflation continues to plague the real estate economy. Median prices rose in a range between 6% and 9% in the South Bay during the period.

Beach: Highest YTD Sales Volume Increase

Sales in the Beach cities jumped from 90 homes in June to 118 in July for a massive 31% monthly increase. This was matched by a 30% annual increase over July of 2023. Month to month statistics, as well as same month last year comparisons have shown tremendous variability this year.

The rapid fire changes precipitated by the pandemic, and subsequently by the Federal Reserve in an effort to keep the economy under control, created wild swings in the number of homes sold. At the same time the shifts in median price were less frequent and considerably less wide-ranging.

Today, looking at the year to date summaries for both, sales volume and median price, the numbers have moderated greatly. Sales volume at the Beach measured against last year has ranged from negative 27% to positive 33%. That huge range smoothed out to 6% growth in the year to date view.

Likewise, the median price, which has been a bouncing ball, declined 3% from June and increased by 11% over July of last year. Comparing the year to date from 2023 to 2024, the median settled in with a 6% increase for the longer term perspective.

Harbor: Highest YTD Median Price Growth

Monthly sales volume in the Harbor area fell 8% to a total of 316 homes sold in July compared to 342 sold in June. Annual sales moved the opposite direction, rising 17% from July of 2023 to July this year. For the first seven months of 2024 sales have fallen 1% compared to the same period last year.

Median prices had fallen 6% in June and have reclaimed that loss with a 6% growth in July. The new median, $848,500, is a 15% improvement over July of 2023. Year to date the median price is up by 9% in the Harbor area over the same seven month period in 2023.

Interestingly, every month this year has been a growth month for the year over year median price at the Harbor. The lowest increase has been 4% in March and again in June. The highest has been 18% in both February and May.

Hill: Highest Median Price In South Bay

Monthly data for the PV Peninsula came in with 73 homes sold for a 22% increase in volume over June. Annually, sales showed a 46% increase over July of 2023, a welcome change from the 24% drop in June vs June numbers. Year to date sales posted a 4% increase in volume over the same seven months in 2023.

PV registered a 12% annual increase in median price to $2,015,000 in July, so far the highest median in the South Bay for 2024. It doesn’t quite reach the $2,300,000 of May, 2023, but is one of the more impressive months in recent years. The monthly increase from June was negligible, but the timing in 2023 coincided with a downward shift in median sales prices. So, the change shows up as a 8% increase in the year to date median.

Inland: Median Price Hits $1,000,000 First Time

Sales volume for the Inland area jumped in July—up 15% month to month for a total of 142 homes sold, and up 9% since July of last year. Being past the halfway point of the year boosts the value of the the year to date statistics which come in at a mere 2% through July.

At the same time, the July median sales price for the Inland cities climbed 15% above July 2023 and hit $1,000,000 for the first time! Last year’s number was pretty run-of-the-mill so lends some import to this year’s improvement. The 2024 year to date median price calculation supports the strength shown by the monthly and annual numbers with a solid 7% increase over 2023.

Why Use Median?

A brief comment on median price and why it’s often used in real estate: Averages are used for a great many things in making comparisons, and for things that change frequently, averages do a great job. Medians, on the other hand, minimize the ‘jerky’ nature of averages and show directional movement better than a lot of up and down action.

A median is exactly the middle of a group of numbers, so that half are higher and half are lower. So the impact of a single outlier number shows less distortion on the longer term trend line of the values. In other words, it’s easier to see what your investment will likely be worth in 10 years.

Most of us don’t buy houses often enough to care about movement over the last 30 days. We’re interested in staying put for 10 years, plus or minus. The median trend will show us the most likely path.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo catalina_from_wayfarers_chapel.jpg by Carl Clark